Other structures: Coverage related to structures on your property that aren’t attached to the house itself, such as fences and outbuildings Most homeowners insurance policies break down their basic coverage amounts into six different types:ĭwelling: The amount of coverage that applies to the structure of your house Use your declarations page for informational purposes and also as a contract between you and your insurance company. This includes your deductible, the types and amounts of coverage included in the policy, and possibly other details.

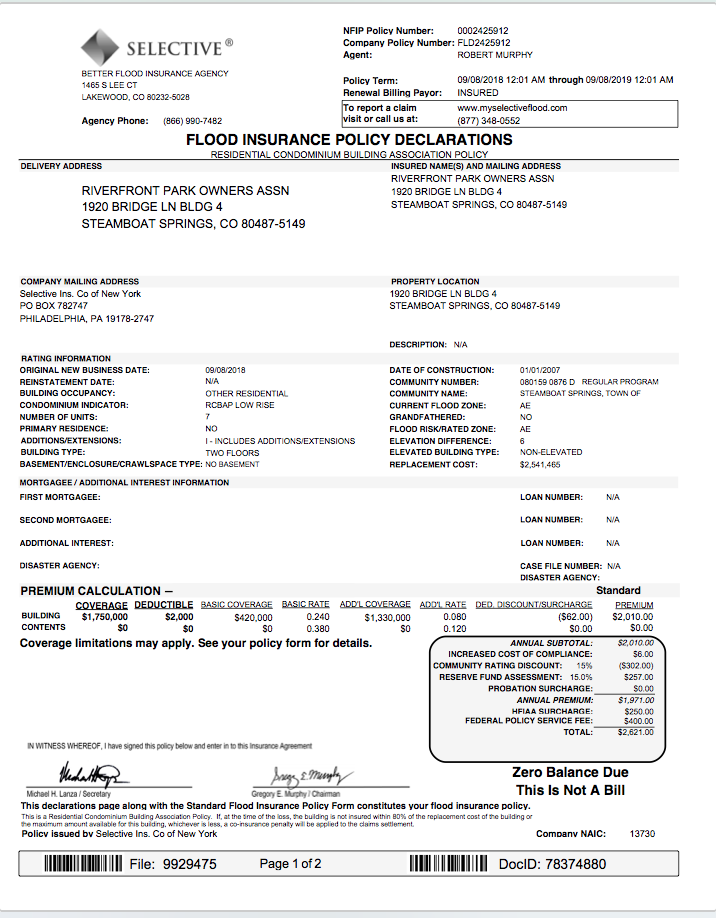

manufactured, masonry, or stick-built), the roof material, and anything else that might have an impact on your policy or premiums.Ī bit further down on the page you’ll see details on your homeowners policy coverage and limits. Some declaration pages go into a bit more detail about your home, including factors such as the type of home construction (i.e. If you bought your policy through an insurance agency, their information will likely show up on the declaration page as well. You’ll also see the insurance company’s name and contact information, your name, the property address, and the policy period (the dates when the policy both begins and ends). This is important information if you ever need to file a claim on your homeowners insurance. In fact, most insurance companies include the declaration page every time you renew your homeowners insurance policy, though some only include it with the initial policy documents.Ī declaration page usually starts with your policy number somewhere near the top. It generally shows up as the first page of your policy documents and serves as an invoice as well. The declaration page is a sort of summary of your home insurance policy.

#Insurance declaration page how to

What is a homeowners insurance declaration page? What’s NOT in a homeowners insurance declaration page? Declaration Page - Frequently Asked Questions How to Use Your Homeowners Insurance Declaration Page See how much you could save on home insurance today! Insurify lets you compare homeowners insurance quotes in a matter of minutes. If you’ve just secured a new policy, it’s not a bad idea to review your dec page to ensure that you’ve successfully secured the coverages you were looking for. You may be familiar with a dec page from your car insurance, renters, or life insurance policies. Your homeowners policy’s insurance declarations page is basically your own personalized FAQs. The declaration page can be very useful in certain circumstances, such as when you need proof of insurance, and it can also save you from having to dig through the entire policy to unearth some detail. Your insurance declaration page will also inform policyholders of their policy terms like effective dates and expiration dates, policy limits, and any add-on products purchased from their insurer, and many other details pertaining to your home insurance policy. While every detail of how your insurance coverage works are spelled out in your homeowners insurance policy, you’ll also find a homeowners insurance declaration page, or dec page, at the beginning of your policy. Homeowners insurance covers many different types of problems that can afflict homeowners. It will summarize the coverages provided by your unique policy. What is a homeowners insurance declaration page?ĭeclarations pages are part of every homeowners insurance policy.

0 kommentar(er)

0 kommentar(er)